Payday loans, also known as cash advances, are short-term loans designed to provide borrowers with quick access to cash. In Wyoming, payday loans are legal and regulated by the Wyoming Division of Banking. These loans can be helpful for those facing unexpected expenses or financial emergencies, but they come with high fees and interest rates.

One common concern for borrowers is their credit score. Many lenders require a credit check before approving a loan, which can be a barrier for those with poor credit. However, there are some lenders that offer payday loans online with no credit check.

While this may seem like an attractive option for those with bad credit, it’s important to understand the potential risks. Payday loans with no credit check often come with even higher fees and interest rates than traditional payday loans. In addition, these loans may have shorter repayment periods, making it even more difficult for borrowers to pay them back on time.

It’s important to carefully consider the terms and fees of any payday loan, whether it requires a credit check or not. Borrowers should only take out a payday loan if they are confident they can repay it in full and on time.

How to Apply for Wyoming Payday Loans with Bad Credit?

If you have bad credit and are in need of a payday loan in Wyoming, there are some steps you can take to increase your chances of approval:

- Gather documentation: In order to apply for a payday loan on Star Loans, you will typically need to provide proof of income, identification, and banking information. Having these documents ready in advance can speed up the application process.

- Consider a co-signer: If you have a friend or family member with good credit who is willing to co-sign your loan, this can increase your chances of approval. Keep in mind that if you are unable to repay the loan, your co-signer will be responsible for the debt.

- Improve your credit: While it may not be possible to improve your credit score in time to apply for a payday loan, taking steps to improve your credit can help you in the long run. Paying bills on time, paying down debt, and disputing errors on your credit report can all help improve your credit score over time.

Am I Eligible for a Payday Loan in Wyoming?

In order to be eligible for a payday loan in Wyoming, you must meet certain requirements:

- You must be at least 18 years old

- You must have a valid government-issued ID

- You must have a verifiable source of income

- You must have an active checking account

- You must provide proof of address

It’s important to note that meeting these requirements does not guarantee approval for a payday loan. Lenders will also consider your credit history and other factors when deciding whether to approve your application.

Benefits of Payday Loans in Wyoming

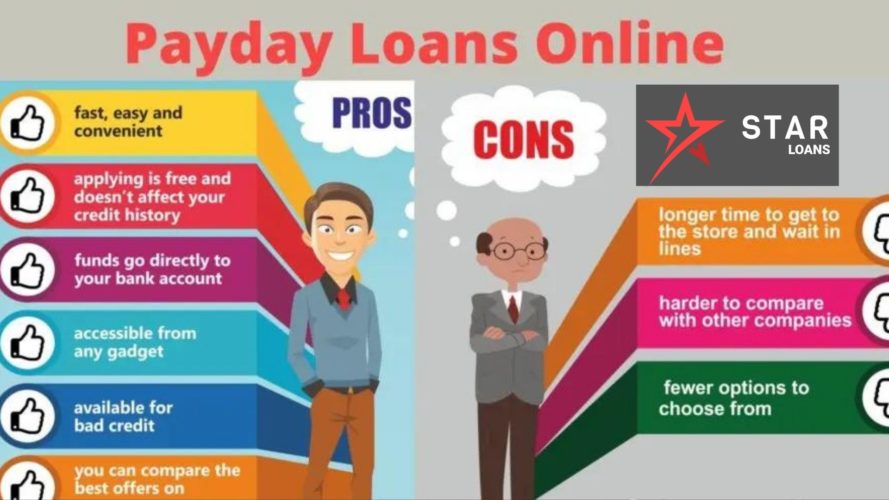

Despite their high fees and interest rates, payday loans can offer some benefits to borrowers in need of quick cash:

- Easy application process: Applying for a payday loan is often a quick and easy process, especially if you apply online.

- Quick access to funds: If you are approved for a payday loan, you can typically receive your funds within a few business days.

- No collateral required: Unlike some other types of loans, payday loans do not require collateral, such as a car or house.

- No restrictions on use of funds: You can use the funds from a payday loan for any purpose, unlike some other types of loans that may have restrictions on how the money can be used.

Wyoming Payday Loan Laws and Regulations

Are Payday Loans legal in Wyoming?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Wyoming. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Legal |

|---|---|

| Average APR | 260.00% |

| Finance Charges | $30 (or 20% per month) |

| Additional Fees | 20% maximum but not more than $20 |

Alternatives to Payday Loans in Wyoming

While payday loans can provide quick access to cash, they come with high fees and interest rates that can make them difficult to repay. If you are in need of cash in Wyoming, there are alternative options you may want to consider:

A title loan is a type of secured loan in which the borrower uses their vehicle as collateral. The amount of the loan is typically based on the value of the vehicle. Like payday loans, title loans come with high fees and interest rates, but they may be an option if you have bad credit.

Personal loans are typically unsecured loans that can be used for any purpose. They come with lower interest rates than payday loans and may be a good option if you need to borrow a larger amount of money or have a longer repayment period.

Installment loans are loans that are repaid in a series of regular payments, or installments, over a set period of time. They come with lower interest rates than payday loans and may be a good option if you need to borrow a larger amount of money or have a longer repayment period.

Can I Apply for a Payday Loan with Low Credit Score in WY?

Yes, it is possible to apply for a payday loan in Wyoming with a low credit score. However, having a low credit score may make it more difficult to be approved for a loan, and may result in higher fees and interest rates.

If you have bad credit and are considering a payday loan, it’s important to carefully consider whether you can afford to repay the loan in full and on time. Taking out a payday loan that you cannot afford to repay can result in a cycle of debt that can be difficult to escape.

The Bottom Line

In conclusion, payday loans can be a quick and easy way to access cash in Wyoming, but they come with high fees and interest rates that can make them difficult to repay. Before taking out a payday loan, borrowers should carefully consider their financial situation and whether they can afford to repay the loan in full and on time.

It’s also important to understand the regulations surrounding payday loans in Wyoming and to be aware of alternative options, such as personal loans, installment loans, and credit counseling. Borrowers should also practice responsible borrowing habits, such as only borrowing what they need and repaying their loans on time.

Ultimately, payday loans can be a useful tool for those facing unexpected expenses or financial emergencies, but they should be used with caution and only as a last resort. By understanding the risks and regulations associated with payday loans in Wyoming, borrowers can make informed decisions about their financial future.