In times of financial strain, payday loans can provide quick and easy relief. For Nevada residents, online payday loans with no credit check offer a convenient solution to address short-term financial needs. This article will cover the process of applying for payday loans with no credit check in Nevada, their benefits, eligibility requirements, and the laws and regulations governing them. We’ll also discuss alternatives to payday loans and responsible borrowing practices.

Online Application Process for Nevada Payday Loans

The online application process for Nevada payday loans is designed to be user-friendly and efficient. By following these steps, you can quickly apply for a payday loan and receive funds in a short amount of time:

- Research and choose a lender: Start by researching various payday loan providers that operate in Nevada. Look for reputable lenders with positive reviews, competitive rates, and clear terms and conditions. On Star Loans we deal with direct lenders only.

- Fill out the application form: Once you’ve chosen a lender, visit their website and complete the online application form. You’ll need to provide personal information, such as your name, contact details, Social Security number, and date of birth. You’ll also be required to submit employment details, including your employer’s name, contact information, and your monthly income. Additionally, you must provide bank account information where the loan funds will be deposited.

- Review and submit your application: Before submitting your application, double-check all the information you’ve provided for accuracy. Once you’re satisfied that everything is correct, submit your application.

- Wait for approval: The lender will review your application and determine whether you meet their eligibility criteria. This process typically takes a few minutes, and you’ll receive an instant decision on your application.

- Loan agreement and funding: If your application is approved, the lender will present you with a loan agreement outlining the terms, interest rates, and fees associated with your payday loan. Read this agreement carefully and make sure you fully understand your obligations before accepting the loan. Once you agree to the terms, the lender will transfer the loan funds to your bank account, usually within one business day.

- Repay the loan: Make sure you repay the loan according to the terms outlined in your loan agreement. This may include automatic withdrawals from your bank account on the due date or manual payments made by you. Failure to repay the loan on time can result in additional fees and negatively impact your credit score.

By following these steps, you can successfully apply for and receive a payday loan in Nevada. Remember to use payday loans responsibly and consider alternative options if they better suit your financial needs.

Eligibility Criteria for Nevada Payday Loans

To qualify for a payday loan in Nevada, you must meet certain eligibility requirements. These include:

- Being at least 18 years old

- Having a valid government-issued ID

- Providing proof of income (e.g., recent pay stubs)

- Having an active checking account

- Being a US citizen or permanent resident.

Advantages of Nevada Payday Loans

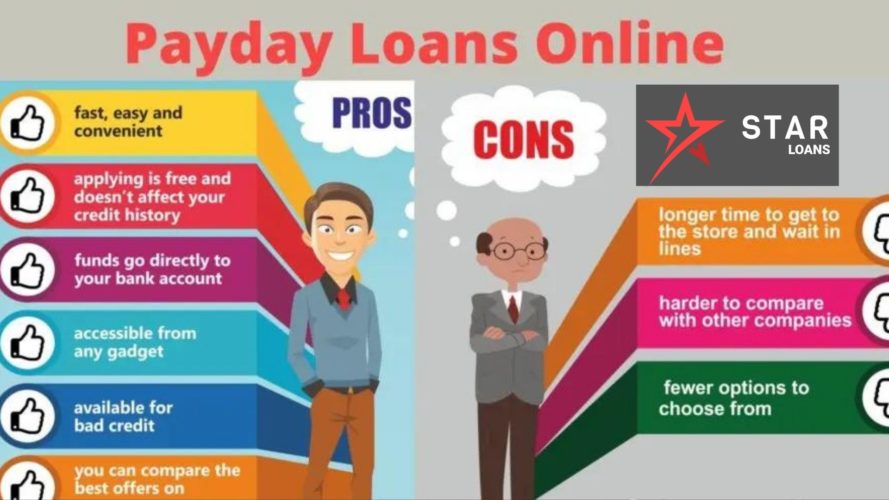

Payday loans offer several benefits, including:

- No credit check: Lenders typically don’t perform a credit check, making it easier for those with poor credit to access funds.

- Fast approval: The online application process is quick, and funds can be received within one business day.

- Easy to qualify: The eligibility requirements for payday loans are generally less stringent than those for traditional loans.

- Short-term solution: Payday loans can help bridge the gap between paychecks, addressing immediate financial needs.

Nevada Payday Loan Laws and Regulations

Are Payday Loans legal in Nevada?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Nevada. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Legal |

|---|---|

| Repayment Term | up to 35 days |

Exploring Alternatives to Payday Loans in Nevada

Payday loans may not be the best option for everyone, especially if you need a larger loan amount or a longer repayment period. Fortunately, there are alternative loan options available in Nevada, including title loans, installment loans, and personal loans. Let’s take a closer look at each of these options.

Title loans are secured loans that require borrowers to use their vehicle’s title as collateral. These loans typically offer larger loan amounts than payday loans, with the loan amount based on the value of the vehicle. Borrowers can continue to use their vehicle while repaying the loan, but the lender can repossess the car if the borrower fails to make timely payments.

2. Installment Loans in Nevada

Installment loans are unsecured loans that allow borrowers to repay the loan over a predetermined period through fixed monthly payments. The interest rates for installment loans are often lower than those for payday loans, and the repayment terms can range from a few months to several years.

Personal loans are another unsecured loan option that can be used for various purposes, including debt consolidation, home improvement projects, or unexpected expenses. Personal loans generally offer larger loan amounts and longer repayment terms than payday loans, and the interest rates are often lower.

In conclusion, it’s crucial to consider all available options before deciding on a payday loan. Title loans, installment loans, and personal loans each have their advantages and drawbacks, and selecting the right loan type depends on your specific financial needs and circumstances. Be sure to compare loan terms, interest rates, and eligibility requirements to make the most informed decision for your financial well-being.

How Many Payday Loans Can You Get in Nevada?

Nevada law doesn’t impose a limit on the number of payday loans a borrower can take out. However, it’s essential to use payday loans responsibly and avoid falling into a cycle of debt.

Embracing Responsible Borrowing Practices in Nevada

To ensure responsible borrowing, it’s important to consider several key factors when taking out a payday loan. First, make sure to only borrow what you can afford to repay. By calculating your monthly expenses, you can determine the loan amount that won’t cause further financial strain.

Second, take the time to read the loan agreement carefully. This will help you fully understand the terms, interest rates, and fees associated with your payday loan. By being informed, you can make the best decision for your financial situation.

Another crucial aspect of responsible borrowing is using payday loans for emergencies only. Avoid relying on these loans for non-essential purchases or long-term financial needs, as they are designed to be a short-term solution.

Planning a repayment strategy is also an essential part of responsible borrowing. Creating a budget that accounts for your payday loan repayment can help you stay on track and avoid falling behind on payments.

Lastly, it’s important to avoid rollovers whenever possible. Paying off your loan in full will prevent additional fees and interest charges, helping you maintain your financial stability.

By following these responsible borrowing practices, Nevada residents can effectively utilize payday loans as a short-term financial solution without putting their long-term financial well-being at risk.

The Bottom Line

Payday loans can be a valuable resource for Nevada residents facing short-term financial challenges. With no credit check and a streamlined application process, these loans offer a convenient way to access funds quickly. However, it’s essential to use payday loans responsibly and consider alternatives before borrowing. By understanding the laws and regulations governing payday loans in Nevada and practicing responsible borrowing, you can address your financial needs while minimizing the risk of falling into a cycle of debt.

Select your city to find the best Payday Loan direct lenders near you

- Las Vegas

- Henderson

- Reno

- North Las Vegas

- Paradise

- Sunrise Manor

- Spring Valley

- Enterprise

- Sparks

- Carson City

- Whitney

- Pahrump

- Winchester

- Summerlin South

- Elko

- Fernley

- Sun Valley

- Mesquite

- Boulder City

- Spanish Springs

- Spring Creek

- Gardnerville Ranchos

- Dayton

- Cold Springs

- Fallon

- Incline Village

- Winnemucca

- Laughlin

- Moapa Valley

- Johnson Lane

- Indian Hills

- Gardnerville

- Silver Springs

- Lemmon Valley