In times of financial emergencies, many people turn to payday loans as a quick solution to their immediate cash needs. Payday loans are short-term loans that are usually due on the borrower’s next payday. They are easy to obtain, but they also come with high interest rates and fees.

If you’re in North Carolina and you’re looking for a guaranteed payday loan, you may be wondering if it’s possible to get one without a credit check. The short answer is no. North Carolina law requires all lenders to perform a credit check before issuing a payday loan. This is to ensure that borrowers are not taking on more debt than they can afford to repay.

However, there are still options available for people with bad credit who need a payday loan. Some lenders may be willing to overlook a poor credit history if the borrower can demonstrate a steady income and the ability to repay the loan on time.

How to Apply for North Carolina Payday Loans for Bad Credit?

To apply for a payday loan in North Carolina on Star Loans, you will need to provide some basic personal information, including your name, address, and employment details. You will also need to provide proof of income, such as a recent pay stub or bank statement.

Once you have provided all the necessary information, the lender will perform a credit check to determine your creditworthiness. If you have bad credit, the lender may still approve your loan application but may charge a higher interest rate and fees to compensate for the added risk.

It’s important to read the terms and conditions of the loan carefully before accepting it. Make sure you understand the interest rate, fees, and due date of the loan. If you’re unsure about anything, ask the lender for clarification before signing the loan agreement.

How to Qualify for a Payday Loan in North Carolina?

To qualify for a payday loan in North Carolina, you must meet the following requirements:

- You must be at least 18 years old.

- You must have a steady source of income, such as a job or government benefits.

- You must have a valid checking account in your name.

- You must provide proof of income and identification.

If you meet these requirements, you can apply for a payday loan in North Carolina. However, it’s important to remember that payday loans come with high interest rates and fees and should only be used as a last resort.

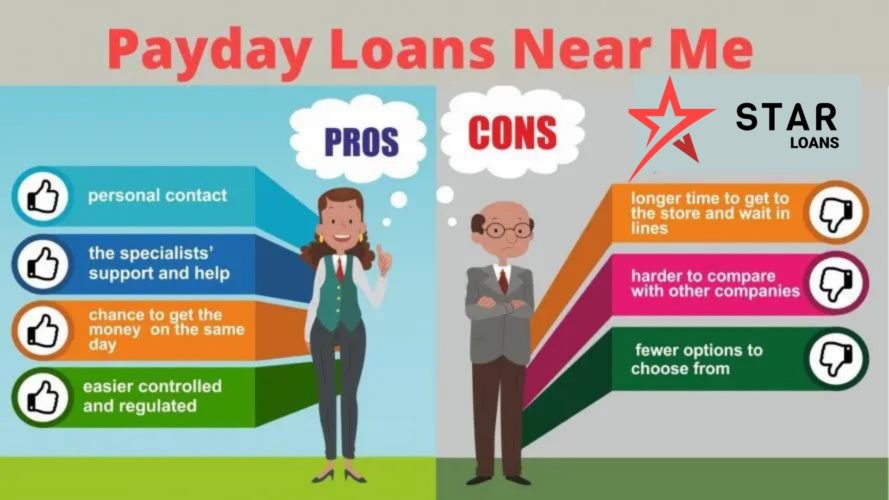

Benefits of Payday Loans in North Carolina

Despite their high cost, payday loans can be beneficial in certain situations. Here are some of the benefits of payday loans in North Carolina:

- Quick access to cash: Payday loans are easy to obtain and can provide quick access to cash when you need it most.

- No collateral required: Unlike other types of loans, payday loans do not require collateral. This means you don’t need to put up any of your assets as security for the loan.

- No credit check required: While a credit check is required to qualify for a payday loan in North Carolina, some lenders may be willing to overlook bad credit if you have a steady income.

- Easy to repay: Payday loans are typically due on your next payday, making them easy to repay. You can either pay back the loan in full or make a minimum payment to extend the due date.

- Can improve credit score: If you make your payday loan payments on time, it can help improve your credit score over time.

North Carolina Payday Loan Laws and Regulations

Before applying for a payday loan in North Carolina, it’s important to understand the laws and regulations governing these types of loans. Here is a table outlining the key laws and regulations for payday loans in North Carolina:

Are Payday Loans legal in North Carolina?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in North Carolina. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Available (with some restrictions) |

|---|

How Many Payday Loans Can You Get in North Carolina?

North Carolina law limits the amount of payday loans a borrower can have at any one time. Borrowers are only allowed to have one outstanding payday loan at a time and must wait at least 24 hours after paying off a loan before taking out a new one.

Can I Get a Payday Loan from Direct Lenders in NC?

North Carolina law prohibits payday lenders from operating in the state. However, some lenders may still offer payday loans online to North Carolina residents. These lenders are often based outside of the state and may charge higher interest rates and fees to compensate for the added risk.

It’s important to be cautious when applying for a payday loan online. Make sure the lender is reputable and licensed to do business in your state. You should also read the terms and conditions of the loan carefully before accepting it.

Alternatives to Payday Loans in North Carolina

If you’re considering a payday loan in North Carolina, it’s important to explore all of your options first. Here are some alternatives to payday loans that may be a better fit for your financial situation:

Installment loans are similar to payday loans but are paid back over a longer period of time. They typically have lower interest rates and fees than payday loans and may be a better option for people who need more time to repay their loan.

Personal loans are another option for people who need to borrow money. They typically have lower interest rates than payday loans and can be used for a variety of purposes, such as debt consolidation or home repairs.

Title loans allow borrowers to use their vehicle as collateral for a loan. While they may offer lower interest rates than payday loans, they also come with the risk of losing your vehicle if you’re unable to repay the loan.

Responsible Borrowing Practices in North Carolina

Regardless of which type of loan you choose, it’s important to practice responsible borrowing. Here are some tips to help you borrow money responsibly:

- Only borrow what you can afford to repay: Before taking out a loan, make sure you can afford to repay it on time. Consider your income, expenses, and other financial obligations before borrowing money.

- Read the terms and conditions carefully: Make sure you understand the interest rate, fees, and due date of the loan before accepting it. If you’re unsure about anything, ask the lender for clarification.

- Don’t borrow more than you need: Only borrow what you need to cover your expenses. Borrowing more than you need can lead to higher interest charges and fees.

- Pay your loan on time: Make sure you make your loan payments on time to avoid late fees and damage to your credit score.

The Bottom Line

Payday loans can be a quick and easy solution to immediate cash needs, but they come with high interest rates and fees that can trap borrowers in a cycle of debt. If you’re considering a payday loan in North Carolina, it’s important to explore all of your options and borrow responsibly.

Remember to only borrow what you can afford to repay and to read the terms and conditions of the loan carefully before accepting it. By practicing responsible borrowing, you can avoid the pitfalls of payday loans and make the most of your financial resources.

Select your city to find the best Payday Loan direct lenders near you

- Charlotte

- Raleigh

- Greensboro

- Durham

- Winston-Salem

- Fayetteville

- Cary

- Wilmington

- High Point

- Greenville

- Concord

- Asheville

- Gastonia

- Jacksonville

- Chapel Hill

- Rocky Mount

- Huntersville

- Burlington

- Wilson

- Kannapolis

- Apex

- Hickory

- Wake Forest

- Indian Trail

- Mooresville

- Goldsboro

- Monroe

- Salisbury

- Holly Springs

- Matthews

- New Bern

- Sanford

- Garner

- Cornelius

- Thomasville

- Statesville

- Mint Hill

- Asheboro

- Fuquay-Varina

- Morrisville

- Kernersville

- Lumberton

- Carrboro

- Kinston

- Clayton

- Shelby

- Havelock

- Clemmons

- Lexington

- Leland

- Boone

- Lenoir

- Elizabeth City

- Morganton

- Hope Mills

- Albemarle

- Pinehurst

- Laurinburg

- Stallings

- Eden

- Harrisburg

- Roanoke Rapids

- Henderson

- Knightdale

- Graham

- Mount Holly

- Murraysville

- Waxhaw

- Mebane

- Reidsville

- Hendersonville

- Southern Pines

- Lewisville

- Piney Green

- Spring Lake

- Newton

- Davidson

- Smithfield

- Archdale

- Summerfield

- Tarboro

- Kings Mountain

- Belmont

- Lincolnton

- Weddington

- Mount Airy

- Elon

- Waynesville

- Dunn

- Washington

- Winterville

- Morehead City

- Rockingham

- St. Stephens

- Myrtle Grove

- Oxford

- Clinton

- Half Moon

- Wesley Chapel

- Pineville