In this new era, where many people find themselves without access to banking services, payday lenders have become an important resource. A no credit check payday loan in New Mexico is a small, short-term loan that’s meant to cover expenses between paychecks, like rent or unexpected car repairs. The interest rates are typically high, but the loans are only meant to be applied as a last resort.

What are Silver City, NM Payday Loans?

A payday loan is designed to help borrowers cover short-term emergency needs by offering fast cash secured by their next paycheck. It’s usully used as the small-dollar cash advance to cover unexpected expenses.

The Silver City, New Mexico Payday Loan is usually due after 14 – 30 days since being deposited into the borrower’s account. After you get the next pay check, the cost of the loan including interest and fees is withdrawn from your checking account automatically.

Payday loans in Silver City, NM are often used by consumers to consolidate debt, to pay off bills, repair a car or redecorate a house, etc. Start with online application or look for loan store locations near you.

How do Payday Loans online work in Silver City, NM?

Silver City, NM payday loans are a quick, safe and convenient way to cover emergency expenses. Like all other short-term cash advances in New Mexico Payday Loans are regulated by the state’s laws. It’s highly recommended to study them in detail before submitting a loan request.

As soon as you’ve decided to apply for the necessary amount there are simple steps to go:

- Fill out an application form online or in any store in Silver City, NM;

- Get matched with a suitable direct lender;

- Receive the money same day in a loan shop or within 1 – 2 days after being approved online.

What are the benefits of Silver City, NM Payday Loans online?

Payday Loans are a perfect option for Silver City residents in the following situations:

- You’ve been rejected by banks and credit unions for your bad credit or bankruptcy or any other reason.

- You like 70% of Americans lack money to pay for everyday bills, utilities, rent, or

- You have numerous debts which must be repaid urgently or they may lead to enormous rates. Use a loan to consolidate these credits into one.

- You feel ashamed or embarrassed to ask your relatives and friends for help.

- You have a not very good credit history and don’t want to affect it by numerous loan requests. No credit check Payday Loans are perfect for you.

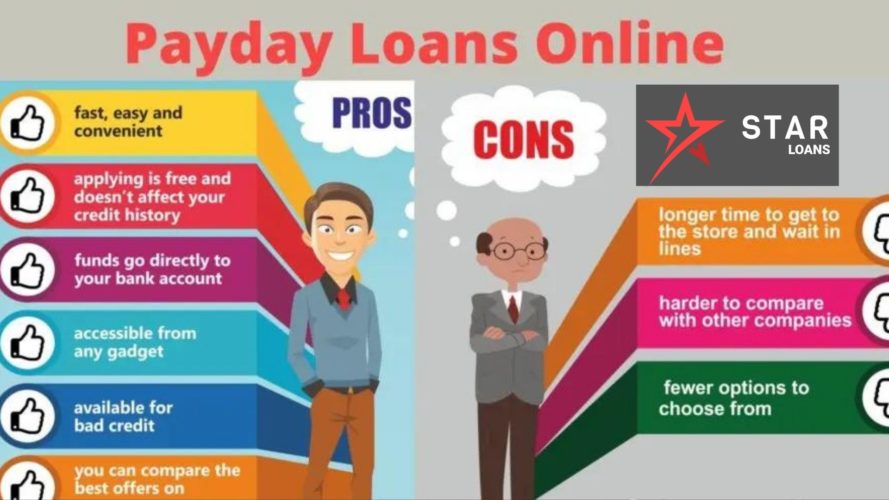

Choosing an online Payday Loan to overcome any of the mentioned above situations you get:

- Instant financing

- 24/7 online service

- Cash advance for bad credit

- No hard credit check loans

- Convenient online application

- Reputable direct lenders with no intermediaries

- What are Silver City, NM Payday loans eligibility criteria?

To be approved for a short-term cash advance a borrower needs to:

- Be over 18 years old;

- Be a resident of New Mexico;

- Have an active banking account;

- Provide a proof of income.

The eligibility criteria may vary according to the lender but all in all they are pretty much the same and don’t usually include any minimal credit score or income requirements.

How much do Payday Loans cost in Silver City, New Mexico?

The cost of Payday Loan as well as any other cash advance in Silver City consists of the principal, the annual percentage rate, or APR and some additional financial charges. The APR varies from 300% to 1200% but on average it’s 400%. It depends on the loan amount, your credit score, the state’s limit, the lender, etc. Besides, you may be charged additional fees such as:

- Verification or loan processing fee.

- Acquisition charges.

- NSF fee, etc.

Silver City Payday Loans are called short-term as they must be repaid till your next paycheck, usually within a month. Lenders usually allow to prepay earlier without any additional fees. In case you can’t pay the money back on time, you may apply for a rollover, extension or repayment plan.

Find out these details with the lender before you submit the loan request.

Can New Mexico borrowers get a Payday Loan with bad credit?

If you are looking for a Payday Loan online in Silver City, New Mexico and you have a bad credit score, you’d better start with online application. You’ll have more chance to find a lender providing such cash advance.

Most of them will approve you for the necessary funds no matter what your credit rating is. They may charge higher interest to make up for the risk. But on the whole bad credit cash advance doesn’t differ from traditional loans.

You apply online and the funds will be in your account within 1 – 2 days, or even same day regardless of the figures on your credit report.

NO credit check Payday Loans in Silver City, NM?

If you used to have some previous debts, or bankruptcies which affected your credit history and your score is not so good as you wish, you may apply for a Payday Loan with no credit check. In Silver City there are lenders providing quick funds with no hard inquiry to the major credit bureaus. They determine your creditworthiness paying attention to your income rather than credit history. But you should be careful and make sure you can afford the loan before applying for it.

Warning about Silver City, NM Payday Loans

We can’t but agree that Payday Loans in Silver City, New Mexico are one of the easiest and fastest ways to receive urgent financing. But you may come across some pitfalls on the way too quick money:

- Additional fees;

- Scams;

- Default penalties;

- Collecting practices;

- Third parties selling your information, etc.

Make sure you borrow from a legal Silver City lender and read the agreement carefully to be on the safe side.

Silver City, NM alternatives to Payday Loans online

If for some reason you want to avoid a short-term Payday Loan, you can choose among the other cash advances available in Silver City:

- Installment Loans up to $5000 for several months;

- $5000 – $35000 Personal Loans repaid in 6 months – 7 years;

- Secured Car Title Loans;

- Various Government Assistance programs;

- Bank loans, etc.

Start your Payday Loan application online or find cash advance locations in Silver City, NM on the map

-

Fast Bucks

-

524 Silver Heights Blvd Ste 4

(575) 388-8010

-

524 Silver Heights Blvd Ste 4

Check Payday Loan rates and terms in the other cities of New Mexico

- Albuquerque

- Las Cruces

- Rio Rancho

- Santa Fe

- Roswell

- South Valley

- Farmington

- Clovis

- Hobbs

- Alamogordo

- Carlsbad

- Gallup

- Sunland Park

- Los Lunas

- Deming

- Chaparral

- Las Vegas

- Artesia

- Portales

- Los Alamos

- Lovington

- North Valley

- EspaГ±ola

- Zuni Pueblo

- Anthony

- Grants

- Bernalillo

- Shiprock

- Socorro

- Corrales

- Ruidoso

- Belen

- Bloomfield

- Lee Acres

- Raton

- Los Ranchos de Albuquerque

- Truth or Consequences

- Eldorado at Santa Fe

- White Rock

- Aztec

- North Hobbs

- Placitas

- Taos

- Meadow Lake