Payday loans are short-term, high-interest loans that offer a quick solution to those who need cash to cover unexpected expenses. In Kentucky, residents can now apply for payday loans online without undergoing a credit check. This article provides a comprehensive guide to Kentucky payday loans, including eligibility criteria, application process, and the state’s payday loan laws and regulations. Additionally, we will discuss alternative loan options available to borrowers and offer tips on choosing the best lender in Kentucky.

Payday loans in Kentucky offer a convenient solution for those with less-than-perfect credit scores. Unlike traditional loans, these loans do not require a credit check, making it easier for borrowers to access funds quickly. This makes payday loans an attractive option for those who need immediate financial assistance but may not qualify for traditional credit lines due to poor or no credit history.

How to Apply for Kentucky Payday Loans Online?

Applying for a payday loan in Kentucky is a straightforward process. Here is a step-by-step guide on how to apply for a padyay loan for bad credit:

- Research and choose a reputable lender that offers payday loans in Kentucky.

- Visit the lender’s website and fill out the online application form.

- Provide the necessary documentation, such as proof of income, identification, and banking information.

- Submit your application and wait for approval.

- Once approved, the funds will be deposited into your account within 24 hours.

Getting a Payday Loan in Kentucky: Eligibility Criteria

To be eligible for a payday loan in Kentucky, borrowers must meet the following requirements:

- Be at least 18 years old

- Be a US citizen or a permanent resident

- Have a valid Social Security number

- Have an active checking account

- Provide proof of steady income (e.g., pay stubs or bank statements)

- Have a valid phone number and email address.

Why Choose Payday Loans in Kentucky?

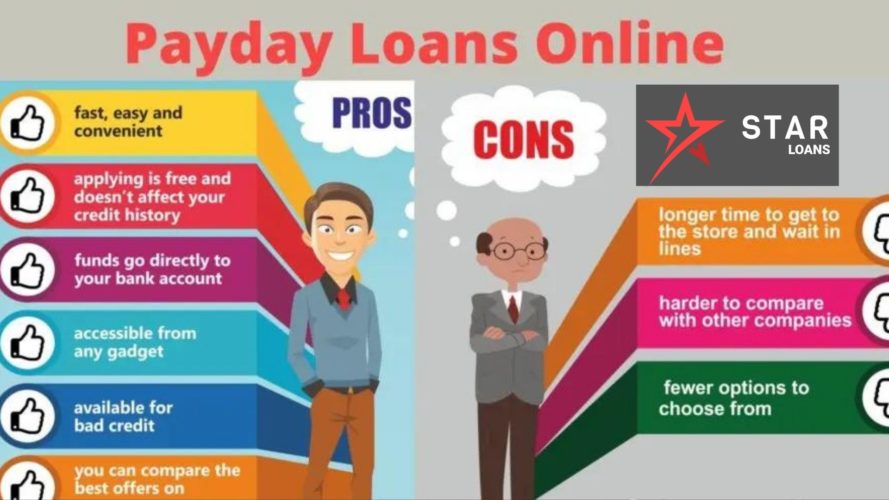

There are several reasons why borrowers may choose payday loans in Kentucky:

- Quick and easy application process

- No credit check required

- Fast access to funds (usually within 24 hours)

- Convenient for covering unexpected expenses

- Helps borrowers with poor or no credit history.

Kentucky Payday Loan Laws and Regulations

Are Payday Loans legal in Kentucky?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Kentucky. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Legal |

|---|---|

| Maximum Loan Amount | $500.00 |

| Repayment Term | 14 - 60 days |

| Finance Charges | $15 per $100 on face value of check + $1 database fee |

| Additional Fees | $1 database fee |

Alternatives to Payday Loans in Kentucky

Although payday loans can be a convenient option for some borrowers, it is essential to consider alternative loan options, as payday loans often come with high interest rates and fees. Some alternatives include:

These loans allow borrowers to repay the loan in fixed monthly installments over a longer period, typically with lower interest rates.

Offered by banks, credit unions, and online lenders, personal loans usually have lower interest rates and more flexible repayment terms than payday loans.

Borrowers can use their vehicle title as collateral to secure a loan. However, it is crucial to note that failure to repay the loan could result in the loss of the vehicle.

How Many Payday Loans Can You Get in Kentucky?

In Kentucky, borrowers can have up to two payday loans at a time. However, the total amount of both loans should not exceed the maximum loan amount of $500. It is essential for borrowers to be cautious when taking out multiple payday loans, as this can lead to a cycle of debt that can be difficult to break.

Choosing the Best Lender in Kentucky

When looking for a payday loan lender in Kentucky, it is essential to consider the following factors:

- Reputation: Research the lender’s reputation by reading reviews from previous borrowers.

- Interest rates and fees: Compare interest rates and fees from different lenders to find the most affordable option.

- Loan terms: Ensure that the loan terms, including the repayment period and any penalties for late payment, are clearly outlined and understood.

- Customer service: A reliable lender should have excellent customer service, making it easy for borrowers to ask questions and address concerns.

- Licensing: Verify that the lender is licensed to operate in Kentucky by checking with the Kentucky Department of Financial Institutions.

The Bottom Line

Payday loans can be a convenient option for those in need of immediate financial assistance, especially for borrowers with poor or no credit history. However, it is crucial to understand the risks and costs associated with payday loans and to consider alternative loan options before committing to a payday loan.

Kentucky residents can apply for payday loans online without undergoing a credit check, making the application process quick and easy. When choosing a lender, it is essential to research their reputation, compare interest rates and fees, and ensure that they are licensed to operate in Kentucky.

By understanding the state’s payday loan laws and regulations and considering alternative loan options, borrowers can make informed decisions that will best suit their financial needs.

Select your city to find the best Payday Loan direct lenders near you

- Louisville

- Lexington-Fayette

- Bowling Green

- Owensboro

- Covington

- Richmond

- Georgetown

- Florence

- Hopkinsville

- Nicholasville

- Elizabethtown

- Henderson

- Frankfort

- Jeffersontown

- Independence

- Paducah

- Radcliff

- Ashland

- Madisonville

- Murray

- Erlanger

- Winchester

- St. Matthews

- Danville

- Burlington

- Fort Thomas

- Shively

- Shelbyville

- Newport

- Berea

- Glasgow

- Mount Washington

- Fort Campbell North

- Bardstown

- Shepherdsville

- Somerset

- Lyndon

- Campbellsville

- Lawrenceburg

- Fort Knox

- Mayfield

- Paris

- Middlesborough

- Alexandria

- Versailles

- Francisville

- Oakbrook

- Maysville

- Hillview

- Franklin

- Edgewood

- La Grange

- Elsmere

- Harrodsburg

- Fort Mitchell

- London

- Middletown

- Morehead

- Villa Hills

- Corbin

- Oak Grove

- Flatwoods

- Mount Sterling

- Highland Heights

- Pikeville

- Russellville

- Leitchfield

- Taylor Mill

- Cynthiana

- Wilmore

- Cold Spring

- Princeton

- Monticello

- Hebron

- Vine Grove

- Central City

- Bellevue

- Union

- Fort Wright

- Douglass Hills

- Lebanon

- Buckner

- Dayton

- Williamsburg

- Westwood

- Hazard