Payday loans are short-term loans that borrowers can use to cover unexpected expenses or bills until their next paycheck arrives. In Illinois, payday loans are legal, but they are subject to regulations and restrictions by the Illinois Department of Financial and Professional Regulation.

One of the advantages of payday loans for bad credit is that they are often available to people with bad credit or no credit history. This is because payday lenders typically do not perform a credit check when approving loans. Instead, they rely on other factors such as the borrower’s income and employment status to determine whether they are eligible for a loan.

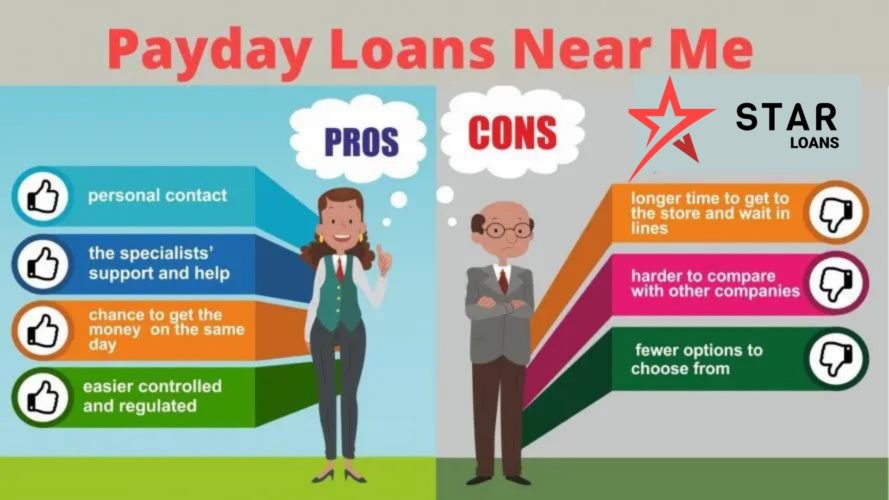

Illinois residents can apply for payday loans online or in-person at a payday lender’s storefront location. Some payday lenders also offer online loans with no credit check, making it even more convenient for borrowers to get the funds they need.

How to Get Approved for a Payday Loan with Instant Approval in Illinois?

If you are considering applying for a payday loan in Illinois, there are a few things you can do to improve your chances of getting approved:

- Check the lender’s requirements: Each payday lender has their own requirements for borrowers, so make sure you meet the minimum qualifications before applying.

- Gather your documents: You will need to provide proof of income, such as pay stubs or bank statements, as well as your social security number and proof of residency.

- Apply online: Many payday lenders offer online applications, which can be more convenient and faster than applying in person.

- Be honest: Provide accurate information on your application, including your income and expenses. Lying on your application can result in your loan being denied.

- Choose a reputable lender: Research the lender before applying to make sure they are licensed and follow Illinois payday loan laws and regulations.

Am I Eligible for a Payday Loan for Bad Credit in Illinois?

In Illinois, payday lenders typically do not perform a credit check when approving loans. However, there are still requirements that borrowers must meet to be eligible for a payday loan, regardless of their credit score. These requirements may include:

- Being at least 18 years old

- Having a valid government-issued ID

- Providing proof of income or employment

- Having a checking account in good standing

- Providing proof of residency.

While payday loans are often marketed as a solution for people with bad credit, it’s important to remember that these loans come with high interest rates and fees. Before applying for a payday loan, consider whether you can afford to repay the loan on time and whether there are alternative financial options available.

Benefits and Risks of Payday Loans in Illinois

Payday loans can provide a quick source of cash for people who need it. However, they also come with significant risks and drawbacks. Some of the benefits and risks of payday loans in Illinois include:

Benefits:

- Quick approval process: Payday loans can be approved in as little as a few minutes, making them a convenient option for people who need cash urgently.

- No credit check: Payday lenders typically do not perform a credit check, making these loans accessible to people with bad credit or no credit history.

- Flexible repayment options: Some payday lenders offer flexible repayment options, such as installment loans, which allow borrowers to pay back the loan over a longer period of time.

Risks:

- High interest rates and fees: Payday loans in Illinois come with high interest rates and fees, which can add up quickly if the loan is not repaid on time.

- Debt cycle: Many borrowers find themselves trapped in a cycle of debt, taking out multiple loans to cover the cost of previous loans and accruing more fees and interest.

- Risk of default: If a borrower is unable to repay their loan, they may face additional fees, legal action, and damage to their credit score.

- Predatory lending practices: Some payday lenders use predatory lending practices, such as charging excessive fees or targeting low-income borrowers who are likely to have difficulty repaying the loan.

Before taking out a payday loan in Illinois, it’s important to carefully consider the benefits and risks and make sure you understand the terms and fees associated with the loan.

Illinois Payday Loan Laws and Regulations

Are Payday Loans legal in Illinois?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Illinois. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Legal |

|---|---|

| Maximum Loan Amount | $1000.00 |

| Repayment Term | 13 - 120 days |

| Finance Charges | $15.50 for $100 borrowed for 14 days |

| Additional Fees | Not more than $15.50 for $100 borrowed |

The regulations and restrictions by the Illinois Department of Financial and Professional Regulation ensure that borrowers are protected from predatory lending practices. While payday loans in Illinois are still a high-cost form of borrowing, the regulations help prevent borrowers from falling into a cycle of debt and make sure they understand the terms and fees associated with the loan.

Alternative Financial Options to Consider in Illinois

If you are considering a payday loan in Illinois, it’s important to explore alternative financial options that may be available to you. Some alternatives to payday loans include:

Installment loans are similar to payday loans in that they are short-term loans that are repaid in installments over time. However, installment loans typically have lower interest rates and longer repayment terms than payday loans.

Personal loans are unsecured loans that can be used for a variety of purposes, including covering unexpected expenses. Personal loans typically have lower interest rates than payday loans and longer repayment terms.

Title loans are secured loans that use the borrower’s vehicle as collateral. Title loans typically have lower interest rates than payday loans but come with the risk of losing the vehicle if the loan is not repaid on time.

- Credit counseling

Credit counseling can help borrowers develop a budget and repayment plan to manage their debt and avoid the need for payday loans in the future.

How Many Payday Loans Can You Get in Illinois?

Illinois law prohibits borrowers from having more than two payday loans at a time from the same lender. Additionally, lenders are not allowed to issue loans to borrowers who already have outstanding payday loans with other lenders, under the Illinois Payday Loan Reform Act.

These restrictions are in place to help prevent borrowers from getting trapped in a cycle of debt, taking out multiple loans to cover the cost of previous loans and accruing more fees and interest.

The Bottom Line

Payday loans can provide a quick source of cash for people who need it, but they come with significant risks and drawbacks. Before applying for a payday loan in Illinois, it’s important to carefully consider the benefits and risks and make sure you understand the terms and fees associated with the loan. If you are struggling with debt or financial difficulties, consider seeking the assistance of a credit counselor or exploring alternative financial options that may be available to you. By taking a proactive approach to managing your finances, you can avoid the cycle of debt that often comes with payday loans and achieve long-term financial stability.

Select your city to find the best Payday Loan direct lenders near you

- Chicago

- Aurora

- Rockford

- Naperville

- Joliet

- Elgin

- Schaumburg

- Downers Grove

- Wheeling

- Palatine

- Waukegan

- Worth

- Thornton

- Cicero

- Proviso

- Evanston

- Lisle

- Maine

- Niles

- Bloomingdale

- York

- Addison

- Plainfield

- Decatur

- Lyons

- Springfield

- Algonquin

- Milton

- Capital

- Peoria

- Berwyn

- Bremen

- Normal

- Peoria City

- Oak Park

- Hanover

- Orland

- Champaign

- Northfield

- Elk Grove

- Leyden

- Oswego

- Bloom

- DeKalb

- Du Page

- Champaign City

- Lockport

- Wheatland

- Frankfort

- St. Charles

- Belleville

- Quincy

- Bloomington

- Bloomington City

- Rich

- Arlington Heights

- Bolingbrook

- Libertyville

- McHenry

- Wayne

- New Lenox

- Vernon

- Warren

- Dundee

- Avon

- Moline

- Skokie

- Edwardsville

- Danville

- Batavia

- Pekin

- Collinsville

- Orland Park

- Des Plaines

- Bourbonnais

- Troy

- Tinley Park

- Winfield

- Oak Lawn

- New Trier

- Grafton

- Rock Island

- Carbondale

- OFallon

- Granite City

- Belvidere

- Palos

- Mount Prospect

- East St. Louis

- Alton

- Wheaton

- Kankakee

- Hoffman Estates

- Urbana

- Lake Villa

- Geneva

- Freeport

- Washington

- Zion

- Glenview