Financial emergencies can hit anyone, anytime. In such situations, payday loans come to the rescue by providing short-term financial assistance. Hawaii payday loans online with no credit check offer an easy and convenient way to access funds quickly without worrying about your credit score. This article will guide you through the entire process, from application to repayment, and discuss the benefits, eligibility criteria, and regulations for payday loans in Hawaii.

How to Apply for Hawaii Payday Loans Online?

To apply for a payday loan in Hawaii, follow these simple steps:

- Research: Start by researching various online lenders and compare their terms, interest rates, and fees.

- Choose a lender: Select a reputable direct lender that offers payday loans in Hawaii.

- Fill out the application: Complete the online application form by providing your personal and financial information, such as your name, address, Social Security number, and employment details.

- Submit documents: Upload any required documents, such as proof of income or identification.

- Review and accept the terms: Review the loan terms, including the repayment schedule and interest rate. If you agree, accept the terms.

- Wait for approval: Most lenders approve applications within a few minutes to a few hours.

- Receive funds: If approved, the lender will deposit the funds directly into your bank account, usually within one business day.

Am I Eligible for a Payday Loan in Hawaii?

To be eligible for a payday loan in Hawaii, you must meet the following criteria:

- Age: You must be at least 18 years old.

- Residency: You must be a legal resident of Hawaii.

- Income: You must have a stable source of income, either from employment or benefits.

- Bank account: You must have an active checking account in good standing.

- Contact information: You must provide a valid email address and phone number.

Note that some lenders may have additional requirements, such as a minimum credit score or employment history.

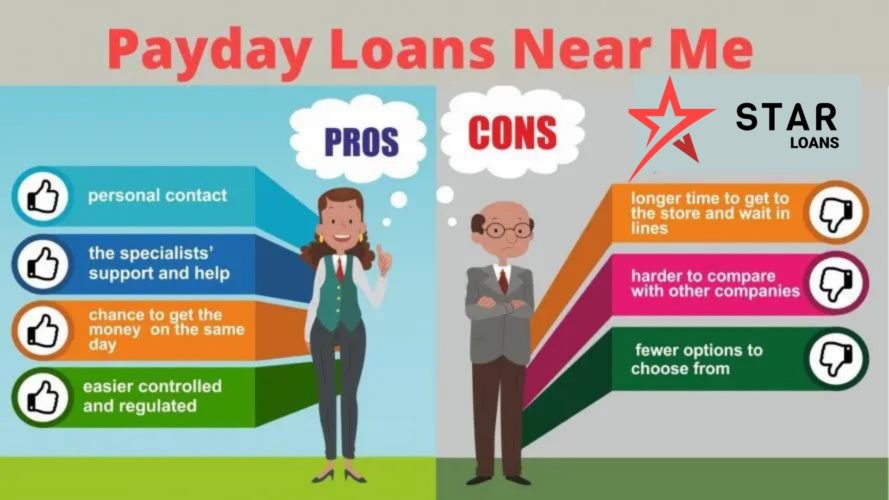

Benefits of Payday Loans in Hawaii

Payday loans in Hawaii offer several benefits, including:

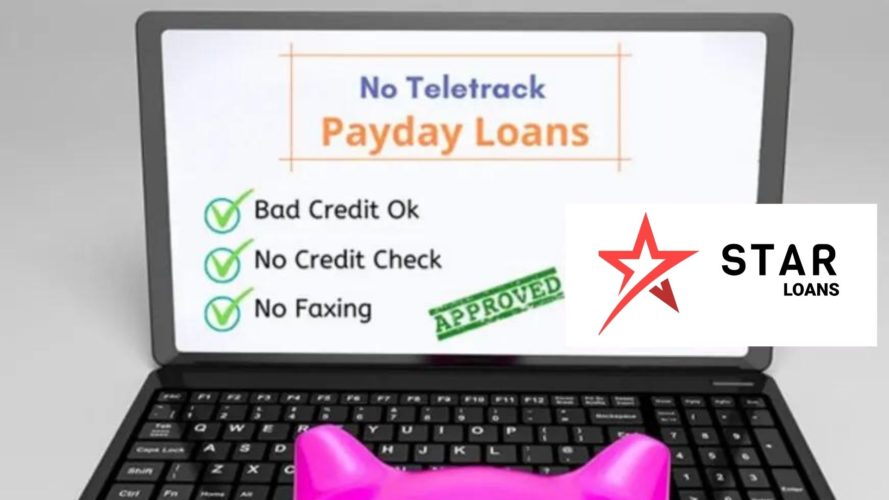

- No credit check: Lenders typically do not perform a hard credit check, making it easier for people with bad credit to get approved.

- Fast approval: Online applications are processed quickly, with approval often granted within minutes.

- Quick access to funds: If approved, you can receive the funds in your account within one business day.

- Flexible repayment: Payday loans are short-term loans, typically due on your next payday, making them easier to repay compared to long-term loans.

- Confidentiality: Online lenders maintain strict confidentiality, ensuring that your personal and financial information remains secure.

Hawaii Payday Loan Laws and Regulations

Are Payday Loans legal in Hawaii?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Hawaii. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Legal |

|---|---|

| Maximum Loan Amount | $600.00 |

| Repayment Term | 32 days |

| Finance Charges | Not more than 15% of the loan amount

|

Consider Other Loan Options in HI

Before applying for a payday loan in Hawaii, it’s essential to explore other loan options that may be more suitable for your financial situation. These options include:

These loans allow you to borrow larger amounts and repay them over a longer period, usually several months or years. They often have lower interest rates than payday loans.

Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. They usually have lower interest rates and longer repayment terms than payday loans, making them a more affordable option.

If you own a vehicle, you can use its title as collateral to secure a loan. Title loans typically have lower interest rates than payday loans and allow you to borrow larger amounts. However, keep in mind that you risk losing your vehicle if you fail to repay the loan.

How Many Payday Loans Can You Get in Hawaii?

In Hawaii, borrowers can take out only one payday loan at a time, with a maximum loan amount of $600. It is crucial to repay your loan on time to avoid additional fees and charges. Since Hawaii does not allow rollovers, you cannot extend the loan term by paying only the interest and fees.

Bad Credit Payday Loans in HI

Bad credit payday loans in Hawaii are an option for borrowers with less-than-perfect credit scores. Since lenders usually do not perform hard credit checks, your credit history might not affect your chances of getting approved. However, it is essential to note that bad credit payday loans often come with higher interest rates and fees compared to loans for borrowers with good credit.

How to Select the Best Direct Lender in Hawaii?

Choosing the right direct lender is crucial to ensure a smooth borrowing experience. Here are some tips to help you select the best lender in Hawaii:

- Research: Look for lenders that are licensed and regulated in Hawaii to ensure compliance with state laws and regulations.

- Compare: Compare multiple lenders based on their interest rates, fees, and loan terms. Read customer reviews to get an idea of the lender’s reputation and customer service.

- Transparency: A reputable lender should provide clear information about their loan products, including the repayment terms, interest rates, and fees.

- Customer service: Choose a lender that offers responsive and helpful customer support, as this can be invaluable if you have any questions or issues during the loan process.

- Security: Ensure the lender’s website uses encryption to protect your personal and financial information.

The Bottom Line

Hawaii payday loans online with no credit check can be a convenient solution for short-term financial emergencies. However, it is crucial to understand the state laws and regulations governing payday loans and consider alternative loan options before making a decision. By following the steps outlined in this article, you can confidently apply for a payday loan in Hawaii and select the best direct lender for your needs. Remember always to borrow responsibly and repay your loan on time to avoid additional fees and charges.

Select your city to find the best Payday Loan direct lenders near you

- Honolulu

- Kailua

- East Honolulu

- Pearl City

- Hilo

- Waipahu

- Kaneohe

- Mililani Town

- Kahului

- Ewa Gentry

- Kihei

- Mililani Mauka

- Makakilo

- Schofield Barracks

- Wahiawa

- Kapolei

- Wailuku

- Royal Kunia

- Halawa

- Ewa Beach

- Waianae

- Waimalu

- Nanakuli

- Lahaina

- Hawaiian Paradise Park

- Waimea

- Waipio

- Kaneohe Station

- Kapaa

- Ocean Pointe

- Kalaoa

- Waihee-Waiehu

- Maili

- Aiea

- Holualoa

- Ahuimanu

- Makaha

- Hickam Housing

- Pukalani

- Waikele