Financial emergencies can happen to anyone, and in times of need, payday loans can be a lifeline for many. In Connecticut, payday loans for bad credit are available online with no credit check, making them accessible to a wider range of people. This article will discuss the process of getting approved for a payday loan in Connecticut, eligibility requirements, benefits, laws and regulations, alternative loan options, and potential risks associated with payday loans.

Payday loans are short-term, high-interest loans that provide quick cash for borrowers to address financial emergencies. In Connecticut, online payday loans are available without a credit check, which means that even individuals with poor or no credit history can apply for these loans. The main focus of payday loan lenders is on the borrower’s ability to repay the loan based on their income rather than their credit history.

How to Get Approved for a Payday Loan Online in Connecticut?

- Research and compare lenders: Browse the internet for reputable payday loan companies that offer their services in Connecticut. Compare the interest rates, fees, and loan terms offered by different lenders.

- Fill out the online application: Choose a suitable lender and complete the online application form. Provide accurate information about your employment, income, and personal details.

- Submit the required documents: Prepare and submit the necessary documents, such as proof of income, ID, and bank account information.

- Review and accept the loan terms: If your application is approved, the lender will present you with the loan terms. Review them carefully and accept the offer if it meets your requirements.

- Receive the funds: The approved loan amount will be directly deposited into your bank account, typically within one business day.

What Do I Need to Apply for a Payday Loan in Connecticut?

To apply for a payday loan in Connecticut, you must meet the following eligibility requirements:

- Age: You must be at least 18 years old.

- Residency: You should be a resident of Connecticut and have a valid state-issued ID.

- Employment and income: You must have a steady source of income, either through employment or another verifiable source.

- Bank account: You need an active checking account in your name for receiving the loan funds and facilitating repayment.

- Contact information: Provide a valid email address and phone number for communication purposes.

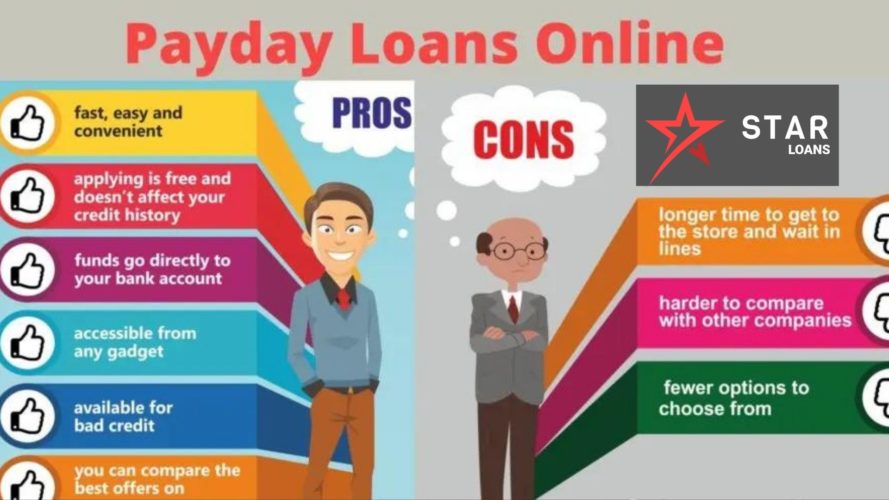

Benefits of Payday Loans in Connecticut

- Fast approval: Online payday loans are known for their quick approval process. In many cases, you can get the funds within one business day.

- No credit check: Payday loan lenders in Connecticut do not require a credit check, making these loans accessible to those with poor or no credit.

- Easy online application: Applying for a payday loan online is convenient and can be done from the comfort of your home.

- Flexible repayment terms: Payday loans usually have a short repayment period, typically until your next paycheck. This can help you avoid long-term debt.

Connecticut Payday Loan Laws and Regulations

Are Payday Loans legal in Connecticut?

Loan Rates and Fees, Laws and Regulations in Payday Loans. Consumer loan act imposes some restrictions on Payday Loans in Connecticut. But one can legally apply for $1000 - $5000 Installment and $5000 - 35,000 Personal loans. According to Md. Code Com. Law § 12-101 et seq.1 and Senate Joint Resolution 7 of 20022 the APR on Payday cash advance mustn’t exceed 2.75% per month; 33% per year.

| Legal Status | Illegal |

|---|---|

| Finance Charges | $17 per $100 up to $600; $11 per $100 up to $1,800; add-on interest |

Please note that while payday loans are technically allowed in Connecticut, the state has strict regulations in place to protect consumers from predatory lending practices. These regulations include caps on interest rates, finance charges, and fees, as well as prohibiting rollovers and criminal action against borrowers.

Borrowers should be aware of their rights under Connecticut law and ensure that they are dealing with a reputable and licensed lender. Before entering into a payday loan agreement, be sure to read the loan terms carefully and understand the total cost of the loan, including interest, fees, and repayment terms.

Alternative Payday Loan Options in CT

These loans offer longer repayment terms and lower interest rates compared to payday loans. Borrowers can repay the loan in installments over a predetermined period.

If you own a vehicle, you can use its title as collateral to secure a loan. Title loans typically have lower interest rates and longer repayment terms than payday loans but require the borrower to own a vehicle with a clear title.

Personal loans can be obtained from banks, credit unions, or online lenders. These loans usually offer lower interest rates and flexible repayment terms. However, they may require a credit check and can take longer to process compared to payday loans.

Are Payday Loans for Bad Credit in CT Possible?

Yes, payday loans for bad credit are possible in Connecticut. Since payday loan lenders do not require a credit check, individuals with poor or no credit history can still apply for these loans. Lenders primarily focus on the borrower’s income and ability to repay the loan rather than their credit score.

How Many Payday Loans Can You Get in Connecticut?

In Connecticut, there is no specific limit on the number of payday loans you can obtain. However, borrowers are advised to exercise caution and avoid taking out multiple loans simultaneously. This can lead to a cycle of debt that becomes difficult to escape. It is crucial to assess your financial situation and ability to repay any loans before applying.

Are There Any Risks Concerning Payday Loans in Connecticut?

Payday loans in Connecticut come with certain risks, including:

- High interest rates: Payday loans are known for their high interest rates, which can make repaying the loan challenging for some borrowers.

- Short repayment terms: The short repayment period can be difficult to manage, especially if the borrower is unable to repay the loan in full by the due date.

- Cycle of debt: Borrowers who take out multiple payday loans or roll over existing loans may find themselves trapped in a cycle of debt that becomes increasingly difficult to escape.

- Impact on credit score: Although payday loans do not require a credit check, failing to repay the loan on time can have negative consequences on your credit score.

The Bottom Line

Payday loans in Connecticut can be a convenient solution for those facing financial emergencies and in need of quick cash. However, borrowers should carefully consider the potential risks and explore alternative loan options before applying for a payday loan. With proper research and responsible borrowing practices, individuals can use payday loans to address short-term financial needs without falling into a cycle of debt.

Select your city to find the best Payday Loan direct lenders near you

- Bridgeport

- New Haven

- Stamford

- Hartford

- Waterbury

- Norwalk

- Danbury

- New Britain

- West Hartford

- Bristol

- Meriden

- West Haven

- Milford

- Stratford

- East Hartford

- Middletown

- Manchester

- Shelton

- Norwich

- Greenwich

- Trumbull

- Torrington

- Naugatuck

- Fairfield

- Hamden

- Newington

- East Haven

- Westport

- New London

- Wethersfield

- Groton

- North Haven

- Wallingford

- Enfield

- Southington

- Darien

- Ansonia

- Glastonbury

- New Milford

- Ridgefield

- Newtown

- Cheshire

- Vernon

- Bethel

- Windsor

- Branford

- Orange

- Mansfield

- South Windsor

- Farmington

- Watertown

- Derby

- Windsor Locks

- Windham

- Simsbury

- Guilford

- Waterford

- Bloomfield

- Berlin

- Colchester

- New Canaan

- Rocky Hill

- Monroe

- Southbury

- Stonington

- Montville

- East Lyme

- Wilton

- Avon

- Madison

- Willimantic

- Wallingford Center

- Plainville

- Brookfield

- Killingly

- Wolcott

- Putnam

- Seymour

- Clinton

- Ellington

- Suffield

- Storrs

- East Hampton

- Plainfield

- Portland

- Ledyard

- Tolland

- North Branford

- New Fairfield

- Cromwell

- Oxford

- Somers

- Coventry

- Stafford

- Plymouth

- Griswold

- East Windsor

- Granby

- Winchester

- Weston